Comfortable with the Basics Series

Why Do So Many Investors Hold Gold? A defensive play in tough times.

Gold has been important to humanity for millennia, in 560 B.C. merchants started using gold as a currency and it has been considered a store of value ever since.

What is a store of value?

A store of value is a currency, commodity or asset that holds its value over a long period of time. A store of value can appreciate in value, but must not depreciate.

Why is gold such a great store of value?

Gold has been humanity’s most widely held and trusted store of value for the last three thousand years and was used as money for much of that period.

There are six key factors that make gold such a great store of value:

- Scarce: Gold is the scarcest precious metal on earth, with gold miners only discovering around 1% more gold per year.

- Divisible: Gold bars can easily be divided into smaller pieces, making it possible to use as payment for smaller items.

- Portable: Gold is incredibly dense and a huge amount of value can be transported in a small amount of space. That makes gold a store of value that you can take with you, wherever you go.

- Liquid: Gold is one of the most liquid assets on earth, with buyers and sellers easily found in every nation on earth.

- Durable: Gold can last for millennia without degrading, unlike other metals.

These innate factors have made gold one of the most popular metals and assets on earth.

Why do so many investors hold gold?

Gold is undoubtedly one of the most popular assets on the planet, held by everyone from central banks worldwide to individuals in India. There are four key reasons that investors choose to hold gold in their portfolio.

1. Defensive play

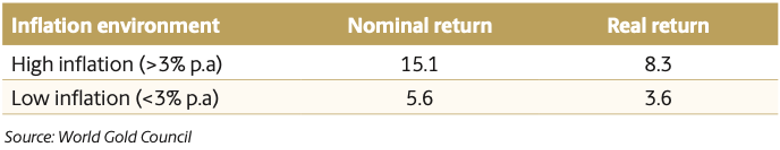

Defensive play Gold is known for maintaining its purchasing power across the centuries, and is considered a defensive play in times of high inflation. For example with current inflation rates of over 6%, the value of a dollar is going backwards, whilst gold continues to perform. The following table highlights the average annual returns for gold in high (>3% p.a.) and low (<3% p.a.) inflation environments across the past 50 years.

Average annual US dollar spot price performance of gold (%).

2. Flight to safety

In times of political and economic uncertainty, investors often flock to the safe-haven asset of gold which offers systemic risk protection. This means that unlike most other forms of wealth that depend on the smooth functioning of a wider system in order to retain its value, gold does not. While there have been many currencies, political parties, and even empires that have collapsed throughout history, gold has been a constant source of stability and wealth preservation.

3. Diversification

Portfolio managers often value diversification above all else. When a portfolio is diversified, it’s more likely that parts of the portfolio are performing well even when other parts may not be. With gold having low correlations to stocks, bonds, and real estate, many money managers consider it to have a place in every portfolio.

4. Strong performance

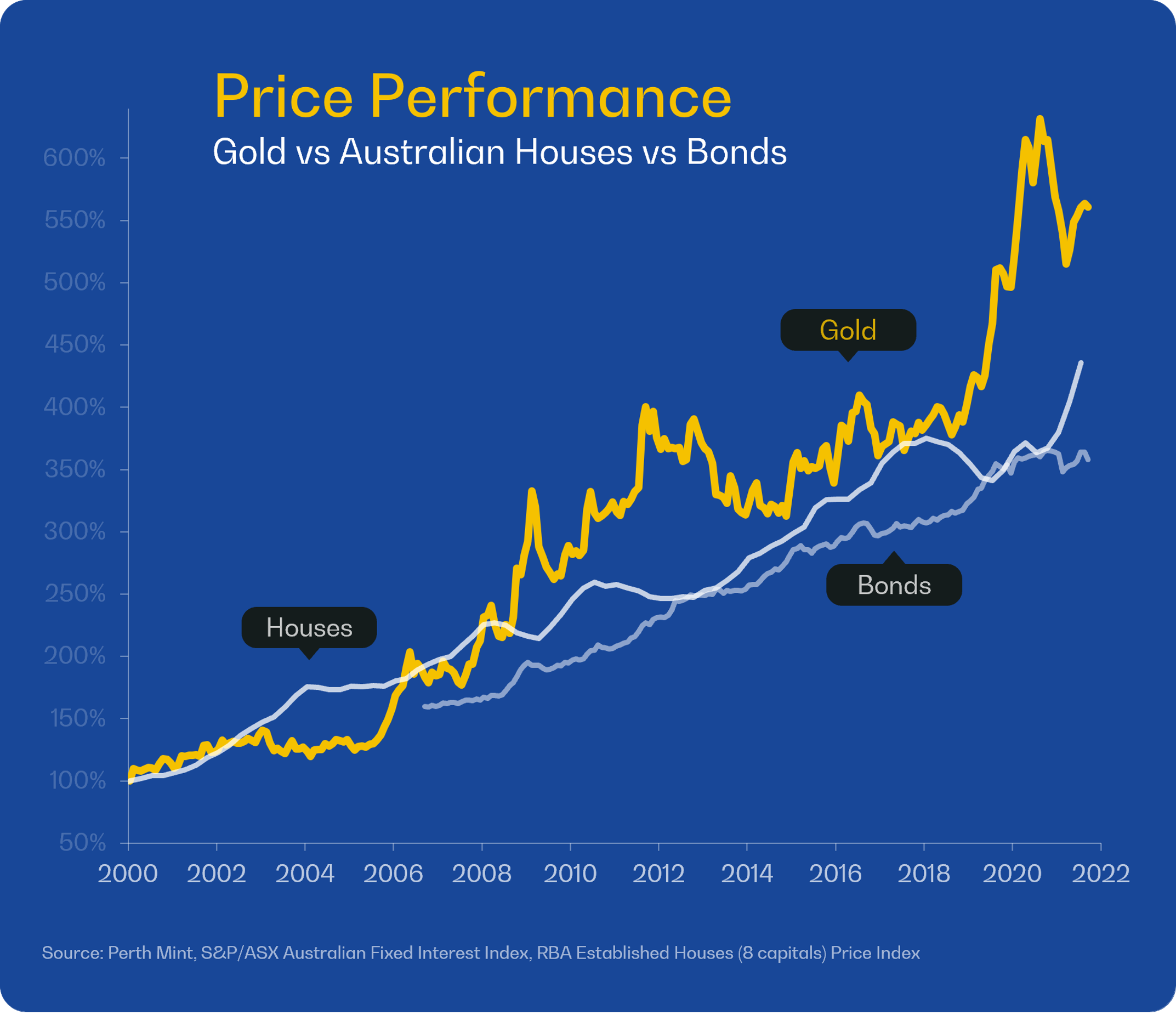

Over the last two decades, returns from gold have closely matched the returns from Australia’s booming housing market. With gold price dropping over the last month, but continued pressure on inflation. – could this be the time to buy?

What do prominent investors say about gold?

Many of the wealthiest investors and largest institutions hold gold in their portfolios. Let’s see some of the reasons that prominent investors are looking at gold:

“When the dollar weakens, it may be a good time for investors to consider adding some gold to their portfolios” — Lisa Shalett, CIO of Wealth Management, Morgan Stanley

“Gold is not necessarily a perfect hedge against inflation but it can be a strategic hedge against inflation,” – Suki Cooper, executive director of precious metals research, Standard Chartered Bank

“If you don’t own gold… there is no sensible reason other than you don’t know history or you don’t know the economics of it.” – Ray Dalio, Founder, Bridgewater Associates

The future of gold

Gold has one of the longest and strongest histories of all asset classes, having been a store of value for thousands of years. While bitcoin is establishing itself as an asset class, it’s possible that the inherent scarcity of both assets will help them perform well if monetary inflation persists. Overall, gold has been a store of value for thousands of years and it likely will continue to be a store of value for thousands more.